Understanding price increases in the tire industry – Part 2

In the first installment of this topic, we discussed how the

global rubber shortage has impacted the price

of tires. Specifically we explored how climate conditions in

Asia hindered the  production of natural

rubber. This in turn, caused demand shortages which triggered

price increases. If you’ve purchased tires recently, you know

that prices have skyrocketed compared to the last time you bought

them. Over the last three years tire prices have increased an

average of 70%. According

to Tire Review, “we are seeing twice-annual tire price

increases, and these are ranging from 5% to 12%.” In other

words a tire that was $100 at the beginning of 2009 is probably

listed around $170 today. From

2005 to today “the same tire costs about 87

percent more.”

production of natural

rubber. This in turn, caused demand shortages which triggered

price increases. If you’ve purchased tires recently, you know

that prices have skyrocketed compared to the last time you bought

them. Over the last three years tire prices have increased an

average of 70%. According

to Tire Review, “we are seeing twice-annual tire price

increases, and these are ranging from 5% to 12%.” In other

words a tire that was $100 at the beginning of 2009 is probably

listed around $170 today. From

2005 to today “the same tire costs about 87

percent more.”

As we’ve discussed in past articles, the primary factors currently influencing tire prices are rubber supply, oil prices, tariffs, emerging markets, supply and demand, and the proliferation of tire sizes. This article will examine how the cost of crude oil impacts tire pricing.

Types of Rubber

There are two types of rubber used in manufacturing tires – natural and synthetic. As we discussed in the previous segment, natural rubber is derived from the rubber tree. The “sap” or latex is harvested and refined to produce natural rubber tires.

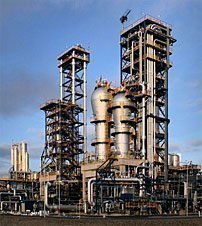

Synthetic

rubber is manmade from petrochemical feedstocks. Crude oil

is the primary raw material. According to the Rubber

Manufacturers Association, it takes “approximately

seven gallons” of oil to produce a single tire. “Five gallons

are used as feedstock (from which the substances that combine to

form synthetic rubber are derived), while two gallons supply the

energy necessary for the manufacturing process.”

Synthetic

rubber is manmade from petrochemical feedstocks. Crude oil

is the primary raw material. According to the Rubber

Manufacturers Association, it takes “approximately

seven gallons” of oil to produce a single tire. “Five gallons

are used as feedstock (from which the substances that combine to

form synthetic rubber are derived), while two gallons supply the

energy necessary for the manufacturing process.”

There are about “1 billion tires made each year”. “70%” of these tires are made of synthetic rubber. That translates to approximately 5 billion gallons of crude oil utilized to make tires each year. As the demand for motor vehicles continues to climb, so too will the need for more tires and indirectly more crude oil to manufacture these tires.

How are Oil Prices Established?

It’s important to understand that oil is purchased in contracts for future delivery. This means that the future price of oil is being established today based on the estimated supply and demand as well as something referred to as market speculation. When news breaks, research analysts and traders on Wall Street use this insight to predict the future impact on the market. In other words, if there is fear or speculation of a potential interruption in oil supply, prices are almost certain to increase.

Market speculation

is a large part of the current situation. Analysts

say there is heightened “tension in the Middle East, including

Iran and Syria, and halted oil production from South Sudan, feeding

into fears about supply.” A potential military confrontation

in the Persian Gulf would directly

impact “20 percent of the world’s oil.” According to New

York Senator

Chuck Schumer “Right now, Iran is using oil as a weapon to

break the will of the United States and Western nations, as we work

to hold the regime accountable for its pursuit of nuclear weapons.”

Iran produces about “2.2 million barrels of oil for export but has

embargoed shipments to France and the United Kingdom and threatened

to stop sending to other countries.” Clearly as international

relations with oil producing countries are disrupted, it creates

uncertainty for our future oil supply. This insecurity pushes

oil trading prices higher.

Market speculation

is a large part of the current situation. Analysts

say there is heightened “tension in the Middle East, including

Iran and Syria, and halted oil production from South Sudan, feeding

into fears about supply.” A potential military confrontation

in the Persian Gulf would directly

impact “20 percent of the world’s oil.” According to New

York Senator

Chuck Schumer “Right now, Iran is using oil as a weapon to

break the will of the United States and Western nations, as we work

to hold the regime accountable for its pursuit of nuclear weapons.”

Iran produces about “2.2 million barrels of oil for export but has

embargoed shipments to France and the United Kingdom and threatened

to stop sending to other countries.” Clearly as international

relations with oil producing countries are disrupted, it creates

uncertainty for our future oil supply. This insecurity pushes

oil trading prices higher.

Additional factors “driving up prices include last month’s bankruptcy of Petroplus, a big European refiner, and a recent BP refinery fire in Washington State that’s temporarily crimped gasoline supply along the West Coast”.

Even though current demand for oil in the US is “down sharply from last year”, global demand for crude oil is growing steadily and expected to increase in 2012 by “940,000 barrels per day”. Much of this is due to strong baseline demand from developing markets including China and Brazil. Based on its use in “fuels and countless consumer goods, it appears that oil will continue to be in high demand for the foreseeable future.”

Since we know that crude oil is the principle material in synthetic rubber tires, it’s reasonable to assume that as crude oil prices increase, so too will tire prices. It also means that the price to transport the tires from the manufacturing facilities to the dealers will cost more money. There is a direct correlation between the price of crude oil and the price of a tire at the dealer.

We will do our best to continually monitor the situation and keep you informed. Please stay tuned for our next segment which will discuss the impact that tariffs are having on tires. As always we welcome your comments and thoughts on this topic.